RentRX

Pay Rent. Build Credit. Earn Rewards. Do Good.

Turning Rent Payments Into Credit-Building Power

My Role

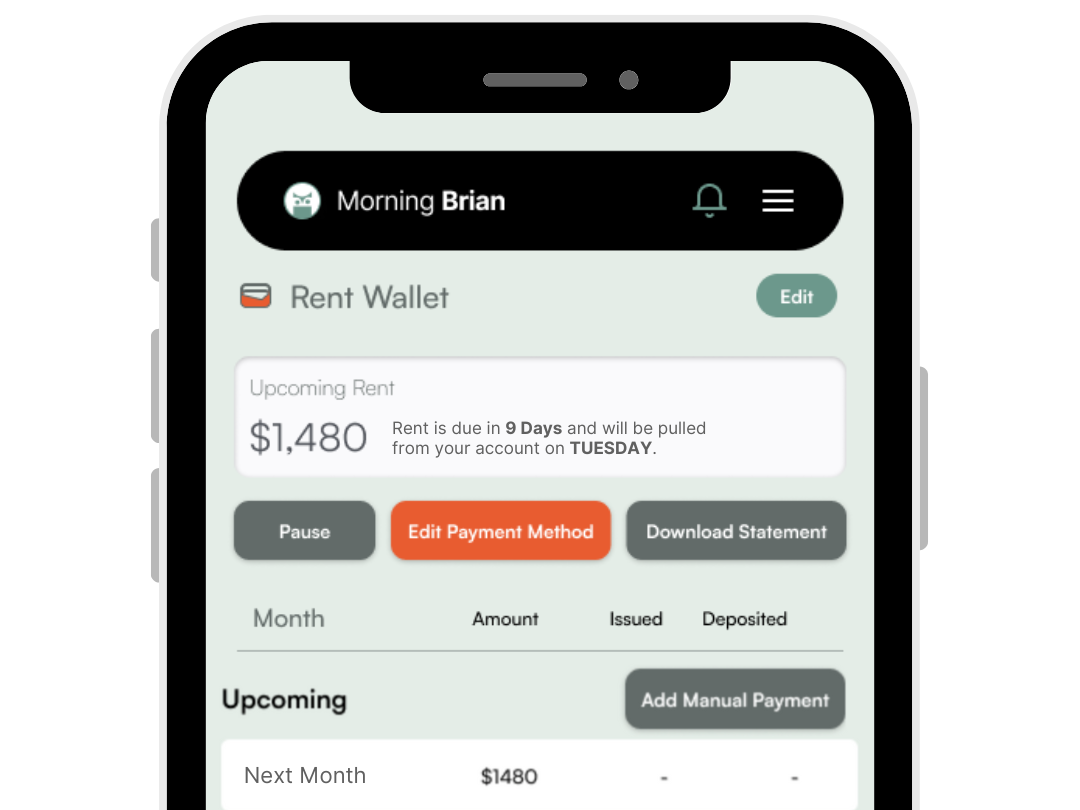

As the product designer for RentRX, I led the design of the mobile app across both iOS and Android platforms. My focus was on creating a simple, trustworthy experience that empowers renters to automate payments, stay on top of their rent, and build their credit — all without adding stress or complexity to their lives.

Overview

RentRX helps renters build and improve their credit by making rent payments count. While rent is often a person’s largest monthly expense, it typically doesn’t factor into their credit history. RentRX changes that by reporting on-time rent payments to the major credit bureaus, transforming a monthly obligation into an opportunity for financial growth.

The Problem

For younger adults and those with limited or no credit history, building credit can feel like a catch-22. You need credit to get credit. At the same time, rent doesn’t usually help you build that history, even though it’s often your biggest recurring bill. Roommates complicate things further, with shared payments, split responsibilities, and varying levels of financial reliability.

People needed an easy, automated way to stay on track with rent — and get credit for doing so.

The Solution

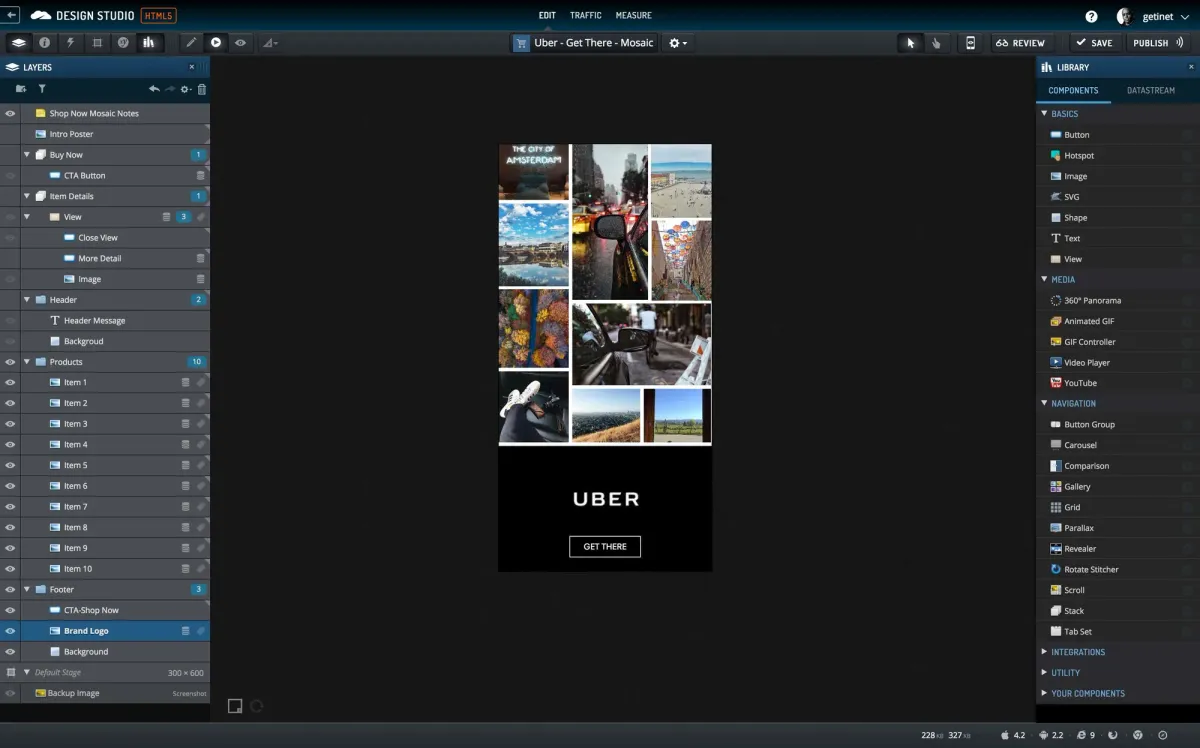

RentRX simplifies the rent payment process and turns it into a credit-building engine. It integrates directly with landlords and securely connects to bank accounts using AHS, enabling automatic, on-time payments. The app reports those payments to the credit bureaus, helping users grow their credit profiles with every rent cycle.

Key Features

- Credit Reporting: On-time rent payments get reported to major credit bureaus, helping users build a positive credit history.

- Bank & Landlord Integration: Securely connects with landlords and financial institutions to automate the payment flow.

- Automated Payments: Set it and forget it. No more missed rent or late fees.

Roommate-Friendly Setup: Easily split rent between multiple users, so no one gets stuck covering the full amount. - Transparent Dashboard: Track payments, credit progress, and stay organized — all in one place.

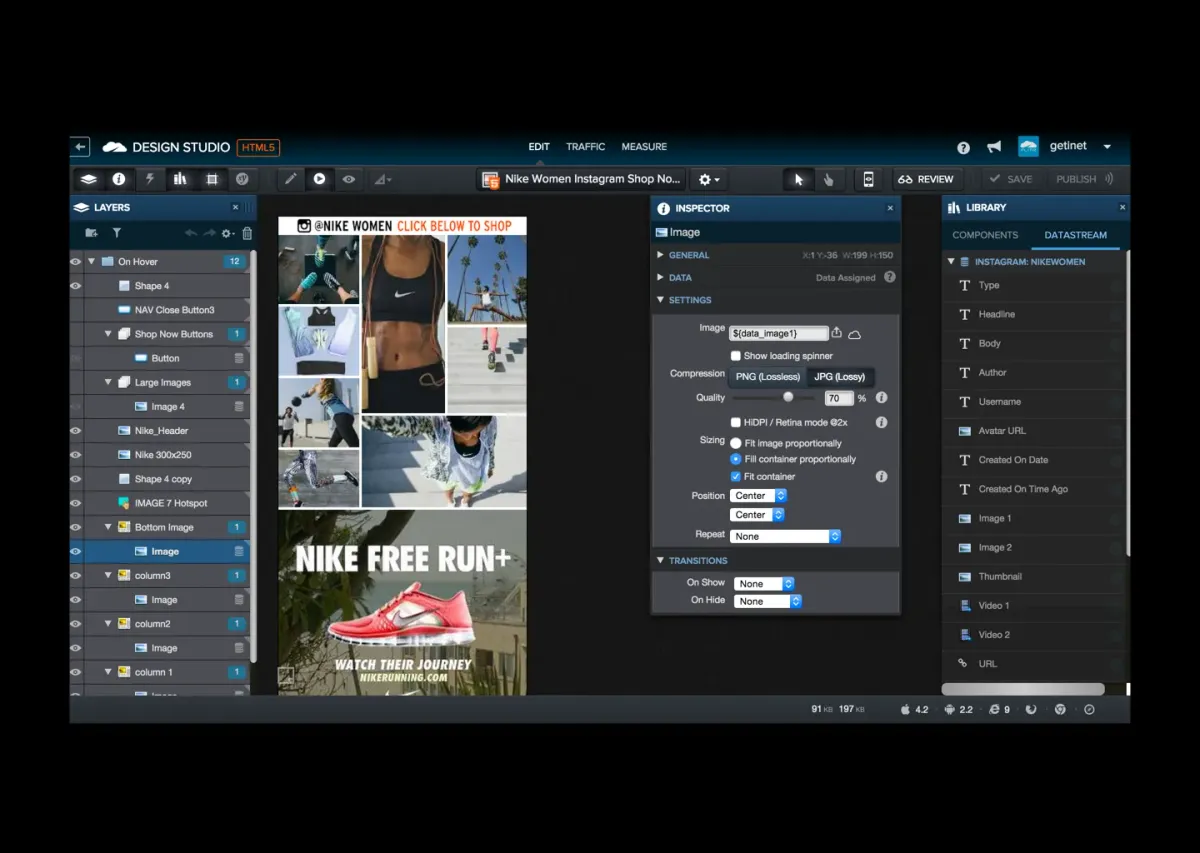

Design Approach & Challenges

One of the core challenges was balancing trust, simplicity, and flexibility. We were asking users to connect financial accounts and automate one of their most important monthly bills. It had to feel secure and transparent at every step.

Another key design goal was making the app work smoothly for both solo renters and shared households. That meant creating flows that accommodated multiple users, split payments, and varied landlord setups. All without adding friction.

On the visual side, I focused on clean, accessible UI and mobile-native interactions to make the experience feel effortless on both iOS and Android.

Impact & What’s Next

RentRX helps renters take control of their financial future by turning rent into a credit-building asset. It’s especially impactful for credit-invisible users — those who’ve never had a credit card or loan but are ready to start building financial credibility.

Looking ahead, future iterations will explore deeper financial insights, gamified rewards for on-time payments, and stronger landlord integrations to drive adoption and engagement.